What is the difference between refinance and consolidation?

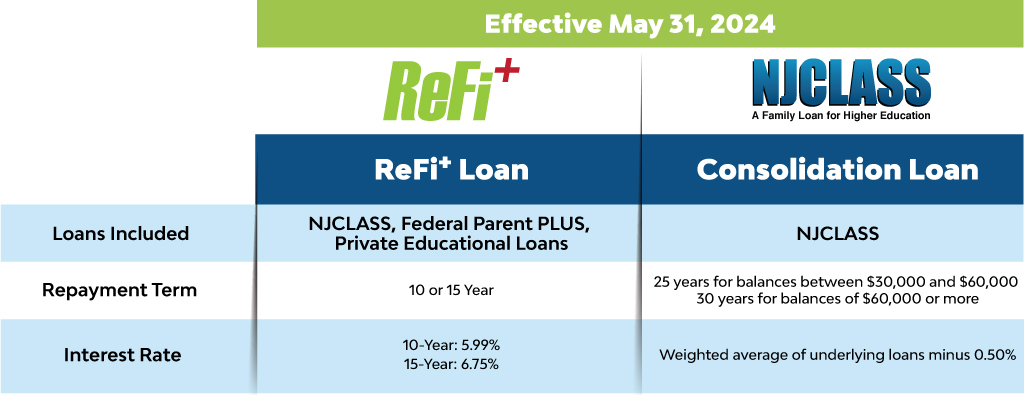

The NJCLASS ReFi+ Loan assists borrowers who want to lower the total amount spent on repaying their student loans by combining multiple loans into one single payment with a lower interest rate. The NJCLASS Consolidation Loan is designed to assist borrowers who need lower monthly payments by combining multiple NJCLASS Loans into one single payment over a longer payment term.

ReFi+ Loan Program

HESAA offers a ReFi+ Loan Program for student beneficiaries who have loans from higher interest rate periods. NJCLASS, Federal Parent PLUS, and Private Educational Loans can both be considered for this refinance opportunity. Eligibility for the 10-year and 15-year, fixed rate program is based on income and credit score. Depending on the selected loan term and credit score, the interest rates will range from 5.99% to 6.90%.

For Frequently Asked Questions, click here

NJCLASS Loan Consolidation

The NJCLASS Consolidation Loan is designed to assist those borrowers with higher NJCLASS debt balances by providing a longer repayment term and lower monthly payments. A consolidation loan may help make payments more manageable for some borrowers by combining several NJCLASS loans into one loan with one monthly payment.

Borrowers must have a minimum of two NJCLASS loans with an outstanding minimum balance of $30,000. NJCLASS Consolidation loans with balances less than $60,000 carry a 25-year repayment term. NJCLASS Consolidation loans with balances greater than or equal to $60,000 carry a 30-year repayment term. The interest rate on a NJCLASS Consolidation loan is fixed and is based on a weighted average of the underlying NJCLASS loans being consolidated minus 0.50%. Deferment and forbearance options are limited and require monthly interest payments. Consolidation loans are subject to available funding.

Borrowers, who would like to apply for a consolidation loan, should login to start the application process.

For Frequently Asked Questions, click here